This page will contain questions and answers that arise during the consultation period. New or updated information will be published at the top, with the date of publication for easy reference. This page will also include documents released during the consultation under the Official Information Act.

If you’d like to ask a question or request information, please email pricingconsultation@caa.govt.nz or attend one of our online information sessions.

| Document title / description | Date published |

|---|---|

| Full consultation document [PDF 897 KB] | 27 Aug 2024 |

| 2024 KPMG Review of AvSec Levies Assumptions [PDF 6.4 MB] | 27 Aug 2024 |

We have identified that 8 continuing fees or levies weren’t listed in Appendix 5 of the consultation document. We can confirm this has no impact on the rates of all fees, levies and charges in the pricing review. The 8 omitted items together have very low activity accounting for 0.009% of Authority revenues and affect a very limited number of sector participants.

For transparency, the items that were omitted are listed below, showing the current price, proposed price, and change, as presented in Appendix 5.

| Product | Type | Current price | Proposed | Change |

|

Participation Levy - aircraft over 100,000kg |

Other Levies |

$11,900.00 |

$5,167.14 |

43% |

|

OP Safety Levy Freight only (10,001 - 50,000 tonne) |

Other Levies |

$2.60 |

$1.13 |

43% |

|

Air Traffic Trainee Licence |

Fixed Fees |

$171.30 |

$74.38 |

43% |

|

Flight Service Trainee Licence |

Fixed Fees |

$171.30 |

$74.38 |

43% |

|

Aircraft Maintenance Engineer (AME): rating |

Fixed Fees |

$173.91 |

$75.52 |

43% |

|

Exchange old aircraft Maintenance Engineer (AME) to lifetime equivalent |

Fixed Fees |

$171.30 |

$74.38 |

43% |

|

Trans-Tasman Mutual Recognition Agreement - Registration of licences under the Agreement |

Fixed Fees |

$171.30 |

$74.38 |

43% |

Levies are charged irrespective of when a ticket is sold to the passenger. The new rates will be charged on a per-passenger basis from 1 July 2025, and so airlines would need to pay these rates, determined on a per-passenger basis, from 1 July 2025.

We determined the total deficit if fees, levies and charges stayed the same, and spread it across each of these business groups proportionate to their share of budgeted costs. Using the average payroll cost per FTE, in each group, we calculated how many FTE need to be reduced, according to the deficit for that group. It should be noted that these figures are only intended to be indicative of the impact if our revenue doesn’t increase.

Under the Civil Aviation (Safety and Security) Levies Order 2002:

For detailed information, please refer to the New Zealand Legislation:

Civil Aviation (Safety and Security) Levies Order 2002(external link)

The Authority has three remuneration Frameworks and in each we seek to ensure that remuneration levels are fair, transparent and free from bias. We seek to ensure that our remuneration is competitive within the employment market to attract and retain talent.

To assist in our evaluation of roles we engage external services of Korn Ferry to benchmark our roles and enable comparison to other benchmark roles across the Public Service and other employers.

Korn Ferry provide evaluation tools that enable us to understand the knowledge, skills and experience required within our roles. This gives us information that enables comparison with many other roles within their data base.

We also ensure that we align our remuneration frameworks with the wider Public Service and, we apply Government Workforce Policy Statements when considering our workforce size, composition and cost. In preparing for our consultation and the cost of role requirements for our future state, we have drawn from current workforce costs and the Treasury BEFU 24 forecasts of wage inflation.

Consultations like this are very formal and regulated processes. After the consultation period closes, all submissions will be analysed to consider the views and points made by submitters, and we may adapt the proposals. We'll then engage with the Minister of Transport to consider the results of the consultation and the options we provide, and revised or confirmed proposals will be taken to Cabinet for approval and implementation.

The proposals we're seeking feedback on are just that - proposals. There are no pre-determined conclusions or decisions. It's critical that impacted and interested parties make submissions to inform final decision-making. Your opinions will not be dismissed, and they are very valuable to this process.

That said, it's important to note that this consultation is not about reaching consensus, which given the number of industry participants will always be difficult to achieve. They are about ensuring decision makers have appropriate information from participants, stakeholders and interested parties to help inform final decisions made by Cabinet.

The Authority is funded primarily through fees, charges and levies to deliver a safe and secure aviation system for the public and the aviation sector of New Zealand. We adhere to the Civil Aviation Act 1990 by monitoring aviation safety, inspection and investigation. Levies are collected more generally to enable the Authority to carry out its statutory functions than to specifically monitor or inspect a particular sector. However, we can confirm surveillance of Part 115 adventure aviation operators has definitely been occurring as part of our monitoring, but for obvious reasons, in the nature of the activity, we cannot go into further detail.

The 2023 Annual report outlines the amount of regulatory activity undertaken in each year. On page 106, Output Class 4 provides information specifically in relation to monitoring, inspection and investigation. 4.1.2 includes the number of oversight activities, audits and inspections that were undertaken in 2022/23.

You can find more detail here:

We have not compared the hourly rate to other regulators within New Zealand or overseas.

Comparing the Civil Aviation Authority of New Zealand with other New Zealand regulators or other national aviation authorities (NAAs) is difficult. There are a range of different ways that regulators around the world collect fees and levies.

Different countries also have different operational structures, and fund different parts of their regulatory activity differently. The costs of specialist staff can vary across sectors and countries.

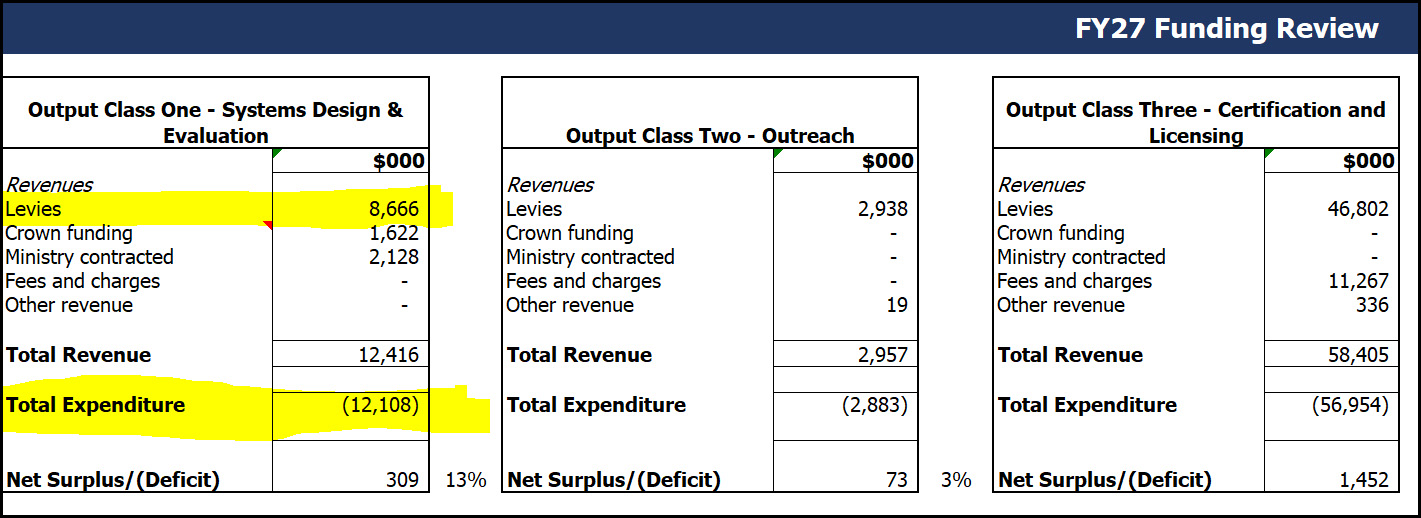

In many cases it is difficult to make a clear-cut distinction between public goods and those that benefit industry, because they overlap. These costs are forecast to be $12,108m by the end of this funding review term at 30 June 2027, with industry funding contributing 70 percent.

Changes to the proportion of the Crown’s contribution are out of scope for this pricing review.

The Authority’s revenue from fees, charges and levies is based on assumed levels of aviation activity. However, the majority of the Authority’s activities do not have a linear to aviation activity or passenger volumes. Costs are driven by a range of other factors including:

Pages 14 to 17 of the Cost Recovery Impact Statement outline the factors driving AvSec and CAA resource increases that are not related to passenger volumes or aviation activity.

As a Crown Entity, the Authority is required to operate as a ‘going concern’. Reserves are required to be maintained to ensure that the Authority operates in a financially responsible manner, that they prudently manage their assets and liabilities, and endeavour to ensure their long-term financial viability and act as a successful going concern. Reserves are needed to also manage timing variances between cash inflows and outflows, as unlike a private sector organisation we can’t have borrowing facilities act in the place of reserves. The Authority Reserves and Funding Policy sets out the thresholds of cash reserves that need to be maintained.

The levels of reserves that are required are a function of:

The Authority was required to deplete its reserves during the COVID-19 pandemic. The purpose of the Pricing review is to return the Authority to being financially self-sustainable and to meet its statutory functions and rebuild its reserves (over time) to have the resilience to cover any future major impacts.

Please refer to the consultation document Appendix 2, pages 43 to 44 that outlines the modelling for reserves and other outputs.

The Authority is required to operate efficiently in the legislation (for example Section 26 of the Civil Aviation Act 2023 requires us to consider delegating and contracting out functions where third parties could perform them ‘most efficiently and effectively’).

In addition, we are held to account in a number of ways to give effect to this. In particular, our annual Statement of Performance Expectations sets performance targets, our Board, the Ministry of Transport and Parliament monitor and scrutinises our performance and expenditure, which includes an ongoing focus on costs and efficiency.

The first priority of the Authority is to deliver a safe and secure aviation system for the public, and a number of independent and external parties ensure we do this in efficiently as we can.

It is also important to understand that we 'cost recover' for those activities, rather than 'revenue generate' – being as efficient as we can, and only recovering costs, minimises the burden for industry.

On funding pressures where we are not adequately 'cost recovering' for what we do. See the 2024 Pricing review consultation document pages 18-19, and greater detail in the first half of the CRIS.

The Director and the Authority can delegate or contract out powers and functions to third parties. For example, a range of recreational organisations are delegated to certify pilot licences in the recreational aviation sector. We also have some substantive services that are contracted out, such as meteorological services to MetService.

We also utilise sector SMEs on an ad hoc basis to support various certification and approval processes when we do not have sufficient internal resource. Depending on the tasks being undertaken, those individuals may be required to have the relevant experience and training to hold a Director delegation to make decisions. We pay these SMEs contract rates, which are usually higher than inspector salaries.

The greater the complexity and aviation safety considerations, the less likely it is that the Director will delegate their decision-making powers.

No. The Authority, its Board and the Minister of Transport are committed to the safety and security in the aviation sector of New Zealand and CAA is audited with specific targets in our annual Statement of Performance Expectations.

As well as conforming with our statute, our regulatory role is to enforce the legal requirements set out by the Minister of Transport and Cabinet, and international standards set by the ICAO and aviation system regulations.

The priority of the Authority is to deliver a safe and secure aviation system for the public, and several independent and external parties ensure we do.

We 'cost recover' for those activities, rather than 'revenue generate', so there is no conflict where the Authority choses activities based on the funding they will provide.

On funding pressures where we are not adequately 'cost recovering' for what we do, please refer to the 2024 Pricing review consultation document pages 18-19, and greater detail in the first half of the CRIS.

No. The 2024 Pricing review consultation document lists other fees, levies and charges, beyond the passenger safety levy and passenger security levies, see Appendix 5 on page 52.

The CAA doesn't have any performance measures or targets relating to the number of 'enforcement activities'. You can read more about our performance measures and outputs in our Statement of Performance Expectations:

Providing a list of other NAAs could be misleading as it's not a simple comparison. Different countries have different operational structures, and fund different parts of their regulatory activity differently.

Our proportion of funding from industry may be higher than some other NAAs that we are aware of. However, this is a long-standing situation that has been upheld by successive governments and changing the model in this review is out of scope.

A pilot's licence is completed as part of the examination by the flight examiner unlike the review needed for the engineer.

There is generally more time spent on assessing a Part 66 AMEL application than a Part 61 Pilot or Part 65 ATS application.

An AMEL assessment covers assessing the applicants Practical Training Record (PTR) and/or training Certificate/s. This is to ensure they have met the broad range of experience requirements for the licence, category, or type rating issue.

AMEL assessments are carried out by CAAs delegated contracted aviation examiner provider Aspeq, who has overseen this role since the late 1990s.

As to costs, this was based on previous funding reviews based on estimates of time taken for the issue.

The Government is committed to keeping these cost increases as low as possible and the Minister has made this expectation clear to the Authority’s Board. The Board changes and the Minister comments reinforce the importance of the work we are doing to improve our performance.

Our new Board was briefed on the 2024 Pricing review consultation and is committed to CAA returning to self-sustainability by 1 July 2025, which requires an increase in the levies, fees and charges that fund us.

The Board Chair delegated authority for the Director of Civil Aviation and Chief Executive to release of the funding review Cost Recovery Impact Statement (CRIS) and consultation document.

The Board is conscious of the cost-of-living challenges facing New Zealanders and that this pricing review will seek to minimise cost increases as much as possible. We are in an environment where pricing has not been reviewed for 7 years for CAA and 5 years for AvSec. Costs have been considered through a rigorous process and deferred as far as possible, efficiencies sought, and performance measures set to drive improvements and value for money.

CAA is predominately a ‘people business’ so wages and exposure to wage inflation constitutes a greater share of inflationary impacts.

Our modelling of 43 percent wage inflation uses Reserve Bank of New Zealand and the New Zealand Treasury, data, weighted for the proportion of CPI and wage inflation in the Authority’s cost base, as outlined below.

|

CPI rates |

100 |

Wage increase |

100 |

||

|---|---|---|---|---|---|

|

FY 2018/19 |

1.7% |

101.7 |

FY 2018/19 |

4.00% |

104 |

|

FY 2019/20 |

1.5% |

103.23 |

FY 2019/20 |

2.90% |

107.02 |

|

FY 2020/21 |

3.3% |

106.63 |

FY 2020/21 |

4.00% |

111.3 |

|

FY 2021/22 |

7.3% |

114.42 |

FY 2021/22 |

6.30% |

118.31 |

|

FY 2022/23 |

6.0% |

121.28 |

FY 2022/23 |

6.90% |

126.47 |

|

FY 2023/24 |

3.4% |

125.4 |

FY 2023/24 |

5.90% |

133.93 |

|

FY 2024/25 |

2.2% |

128.16 |

FY 2024/25 |

3.80% |

139.02 |

|

FY 2025/26 |

2.0% |

130.73 |

FY 2025/26 |

3.10% |

143.33 |

|

FY 2026/27 |

2.0% |

133.34 |

FY 2026/27 |

3.00% |

147.63 |

|

Cumulative |

33.3% |

Cumulative |

47.60% |

||

|

Weighted ratio |

33% |

67% |

|||

|

Weight increase |

43% |

For further information, see:

The Cost Recovery Impact Statement (CRIS) contains significantly greater detail on the factors driving AvSec’s FTE increases than the public consultation document because it is an internal technical statement prepared for officials.

Refer to pages 15-17 for an overview of issues specifically relating to this question, Table One page 22, and Table Two on pages 26-30 for more detailed context.

To a certain extent, internal projects depend on subject matter expertise from our frontline inspectorate and other areas of the organisation. While currently we’ve reduced frontline inspectorate support on internal projects to enable focus on core certification activities, as you’ve noted in the consultation document, we expect that by increasing FTE those teams would be able to resume focus on wider work while also improving other deliverables. There is always a balance to strike in ensuring our teams deliver frontline tasks in a timely way, while also ensuring their subject matter expertise is available to progress matters that affect the wider system, which can include internal projects. Any work that is of immediate safety concern is of course supported and resourced. All our work, and which teams are responsible, is determined through annual business planning processes. Decisions are made by our Authority Leadership Team (ALT) in consultation with the Board.

CAA doesn’t hold sufficient information about participants and operators in the New Zealand aviation system, to effectively evaluate that impact.

This information is, however, an important consideration for the pricing review, and we encourage you to include information that demonstrates the impact of the proposed increases. This could include financial reports or forecasts, and other information about your organisation and operations. If any such information is commercially sensitive, please indicate this in your submission, so that it may be withheld under the Official Information Act 1982, when the submissions are made public.

Along with answering the key questions, we encourage you to include information that demonstrates the impact of the proposed increases. This could include financial reports or forecasts, and other information about your organisation and operations. If any such information is commercially sensitive, please indicate this in your submission, so that it may be withheld under the Official Information Act 1982, when the submissions are made public.

A pricing review of this nature is a complicated process that has been undertaken in coordination with the Ministry of Transport. We've endeavoured to allow as much time for the consultation period as possible and practical.

In the consultation home page, you will find the Cost Recovery Impact Statement (CRIS) for the proposals. This document contains significantly greater detail on the factors driving AvSec’s FTE increases than the public consultation document because it is an internal technical statement prepared for officials. I would draw your attention to pages 15-17 for an overview of issues specifically relating to your question, Table One page 22, and Table Two on pages 26-30 for more detailed context.

There are no additional costs associated with environmental protection.

This function is spread across multiple groups and teams, as it is integral to our role in enforcing standards set by Government in relation to the environment, and in enabling the aviation sector to advance initiatives that reduce emissions.

This ranges from noise control monitoring to certifying new technology that reduces emissions.

The wording that you've drawn from our consultation documents is taken from our website.

30,061 is the number of pilot licences published in CAA’s 2023 annual report. It represents all those who hold a pilot’s licence in the New Zealand aviation system.

The consultation documentation (and annual report) shows there are 30,061 pilots in the NZ system who hold a pilot’s licence.

This compares with 32,849 pilots in Australia and 52,395 pilots in the United Kingdom systems.

There are different ways in which individual countries define their data and the system is not easily comparable globally.

The passenger levies and fees that the Authority charges are charged to airlines, which can be recovered based on passenger numbers each month.

Whether an airline chooses to pass on those costs to their customers directly or part thereof, is the airline’s commercial decision that each airline makes on their own.

This is a different approach from, say, other jurisdictions as the United States where they pass on their Transportation Security Administration equivalent costs directly to the travelling public.

We are aware of the time delays that the sector face and these issues are directly referred to in the documents around the consultation.

The Authority, its Board and the Minister of Transport are committed to improving these wait times and there are specific targets in our Statement of Performance Expectations 2024-25 in that regard.

Yes. The registration of your private aeroplane would increase. You can find more details on fees, levies and charges under the preferred option on page 52 of the 2024 Pricing review consultation.

A date hasn’t been set for when the first principles funding review will begin. It will depend on this current review. Seeking advice on different funding models would be part of that process.

No, PEDs are not in the scope of this consultation.

Those charges are not administered by the Civil Aviation Authority. We do not receive any funding from the petrol excise duty.

Somewhat. All attendees will have the opportunity to ask questions in a written format through the Q&A tool. There won’t be an opportunity for attendees to speak.

The Q&A will be moderated to remove any questions that are abusive or inflammatory, or those that are repetitive.

It is our intention to be as transparent as possible with what people are asking, and the answers to those questions.

The Q&A tool will also allow people to share feedback comments, but these won’t be shown to the wider audience, to allow people to provide their thoughts privately.

No. This is an open consultation and we are taking significant care to ensure that we don’t influence the outcome.

It’s our role through this process to employ as many methods as practical to bring the consultation documents to people’s attention, help them understand the documents and the proposals, and to encourage them to make formal submissions. This is where the online sessions come in.

It isn’t our role to facilitate forums for stakeholders to discuss their views with each other and it wouldn’t be appropriate. We wouldn’t be able to effectively or reliably integrate that discussion in the consultation analysis process. That would set the wrong expectations with stakeholders, and is likely to compromise the integrity of the consultation.

Our formal submission process through the website or email ensures that everyone has the same opportunity to contribute to the consultation. All formal submissions will be considered and published, and in addition we’ll consider any other insights received through the process, to make sure the total themes are consistent or identify any discrepancy between formal submissions and other insights.

There are no final decisions made until after the consultation process, and those final decisions will be made by Cabinet.